You are not simply buying hats. You are choosing a hat supplier structure that will quietly shape your brand’s risk, speed, and long-term scalability.

Most U.S. hat buyers don’t realize this at the beginning. The realization usually comes later—after a shipment arrives late, after crown shapes vary from box to box, or after embroidery that looked perfect on samples fails during bulk production. At that point, the issue is no longer price. It’s accountability.

This article is written for U.S. hat brand owners, operators, and sourcing managers who want to understand who they are really buying from, how supplier structure affects decision-making, and why the wrong setup can drain time, margin, and focus—even when the unit price looks attractive.

What Is a Hat Supplier — and Why It Matters More Than You Think

A hat supplier is not defined by what they sell, but by what they control.

Two suppliers can quote the same hat at the same price, using the same fabric and embroidery method, yet deliver completely different outcomes. The difference is rarely skill—it is structure. Specifically: who makes decisions, how information flows, and what happens when expectations are not met.

For U.S. buyers, this matters because mistakes in hat manufacturing don’t stay isolated. A delayed delivery affects launch schedules. Inconsistent fit affects customer reviews. Quality issues affect retailer trust. These are business risks, not production inconveniences.

When evaluating a hat supplier, the real questions are:

Who has authority to resolve issues quickly?

Who translates your feedback into factory-level actions?

Who absorbs the cost when something goes wrong?

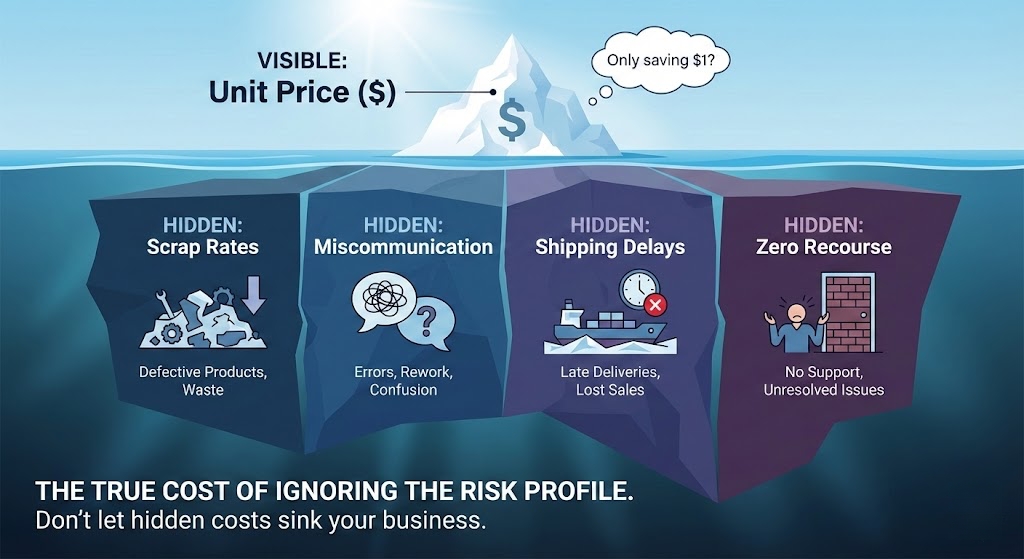

Those answers define your true cost—far more than unit price ever will.

..it’s about the total cost of ownership. But here’s the kicker… most of these costs are invisible until it’s too late.”

As the diagram shows, a $1 saving per unit becomes irrelevant if your business is sunk by the weight of these hidden liabilities. This is why mature brands prioritize structure over initial quotes.

Hat Supplier Type #1 — Direct Factory

A direct factory can be an effective hat supplier, but only under very specific conditions.

Factories are designed to manufacture efficiently at scale. They are not designed to guide buyers through uncertainty, clarify vague requirements, or proactively flag risks. When everything is defined clearly and volumes are large, this model works well.

Direct factories are typically a strong fit for:

- Programs exceeding 10,000 units

- Buyers with on-site QC teams or local representatives

- Mature brands with standardized, repeatable products

For smaller or growing U.S. brands, the challenge is rarely quality capability. It is management burden.

Without someone bridging decisions, factories will default to efficiency over nuance. That means fewer questions, faster assumptions, and less patience for iteration. Over time, this puts the buyer in a reactive position—constantly correcting instead of controlling.er time, this puts the buyer in a reactive position—constantly correcting instead of controlling.

A Simple Comparison: Factory vs Trading Company vs Hybrid

Here’s a quick overview of how different supplier models compare across key factors:

| Decision Factor | Direct Factory | Trading Company | Hybrid Model |

|---|---|---|---|

| Contract entity | Overseas factory | Intermediary company | U.S. entity |

| Payment destination | Overseas bank account | Mixed / overseas | U.S. bank account |

| Decision authority | Factory-side | Diffused / unclear | Centralized |

| Fit for SMBs | Low | Medium | High |

| Risk exposure | High | Medium | Low |

Hat Supplier Type #2 — Trading Company

A trading company often presents itself as a full-service hat supplier, offering convenience, flexibility, and fast quoting. For many buyers, especially first-timers, this can feel like a relief.

This model works best when products are generic, customization is light, and expectations are flexible. In those scenarios, speed and simplicity outweigh precision.

Trading companies often act as professional translators, making the initial start feel effortless. What’s the catch? While they are good at talking, they don’t own the machines.

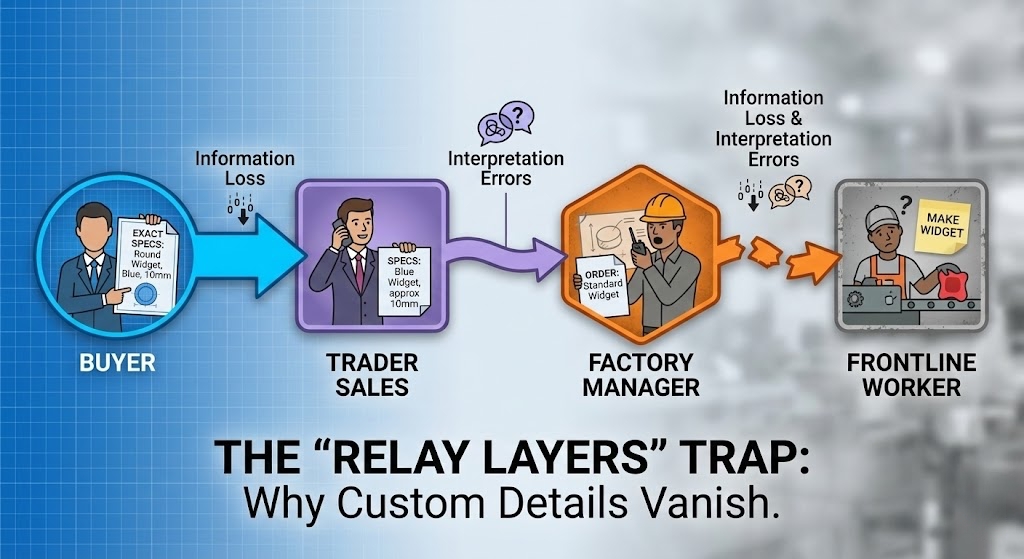

As the diagram illustrates, technical feedback becomes painful when it has to pass through layers of relays. By the time your request reaches the person actually sewing the hat, your ‘exact specs’ have often turned into ‘best guesses.’ This structural friction is why custom details vanish over time.

The challenge emerges when a brand requires technical accuracy: specific crown shapes, embroidery density limits, panel construction details, or fit consistency across reorders.

Each additional communication layer introduces information loss. Feedback becomes interpretation. Interpretation becomes assumption. Over time, small gaps compound into visible inconsistencies—often without a clear point of accountability.

What initially felt “easy” can slowly turn into friction, rework, and delayed decisions.

Hat Supplier Type #3 — Hybrid Model

A properly structured hybrid hat supplier model is designed to reduce risk without sacrificing cost efficiency.

In this structure:

- Contracts and payments are handled through a U.S. entity

- Production is executed directly at the factory level

- Decision-making authority is centralized and clearly defined

For U.S. buyers, this model changes the risk equation. Communication happens in your time zone. Expectations are framed in your business context. Accountability is governed by familiar legal and financial systems.

You are not relying on informal assurances or distant escalation paths. You are operating within a framework designed to reduce ambiguity and shorten response time—without adding unnecessary cost layers.

This is not about adding a middleman. It is about adding a control layer.

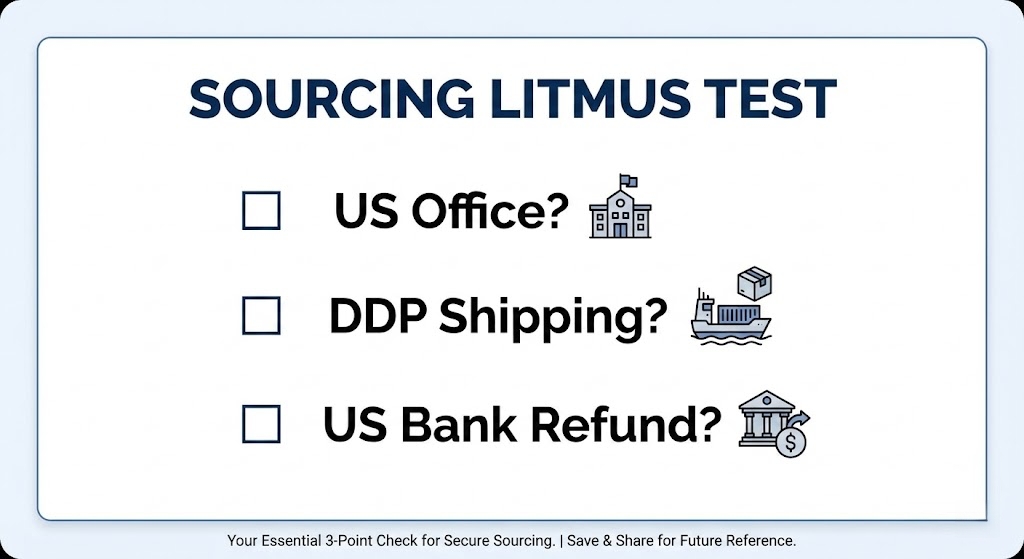

How Buyers Can Identify the Difference (The “Litmus Test”)

To quickly identify which type of hat supplier you’re working with, ask the following questions. The answers will reveal key details about how decisions are made and who holds the responsibility.

“If the hats are wrong, which bank account refunds me?”

This is a critical question. If they can’t answer confidently, there’s a strong chance you are dealing with a supplier who has little skin in the game.

“Can I visit your U.S. office?”

A pure factory won’t have a U.S. office, and trading companies may only have a virtual address. However, in the hybrid model, we often meet with clients in the U.S. — whether at a small office or even remotely — to ensure clear communication and prompt response. What’s most important is that we’re fully available and accessible to support you in your time zone.

“Who handles customs clearance?”

Pure factories and trading companies often push customs responsibilities to the buyer, whereas hybrid models typically handle this directly with DDP (Delivered Duty Paid).

Conclusion

Choosing the right hat supplier is ultimately a strategic decision, not a purchasing task.

This article has shown why supplier structure affects risk, decision speed, and scalability—and why the cheapest option often carries the highest hidden cost.

For U.S. hat brands, the goal is not just to receive hats on time. It is to build a supply chain that protects focus, margin, and reputation as the business grows.

If you are evaluating sourcing options and want clarity on which structure fits your current stage, contact us today to start that conversation.

Our belief is simple:

U.S. brands deserve predictable supply chains—not guesswork.

FAQ

Can I work directly with a factory if my order volume is small?

Generally, no — at least not without added risk.

Direct factories are optimized for large, repeatable orders and usually expect buyers to manage specifications, QC, and production decisions themselves. For small or growing brands, limited leverage and slower response times often lead to misalignment, even if the factory has strong technical capability.

What’s the best hat supplier model for a growing U.S. brand?

In most cases, a hybrid model offers the best balance.

Growing brands need factory-level pricing but also require clear communication, faster decisions, and legal accountability. A hybrid structure supports scaling without forcing the buyer to manage every production detail themselves.

How do I know if my current supplier is a trading company or something else?

Ask a few practical questions and listen carefully to the answers.

Questions about where contracts are signed, who controls production decisions, and where refunds come from usually reveal the true structure. Vague answers often indicate diffused responsibility.

Can a cheaper unit price actually cost me more in the long run?

Yes — and this happens more often than buyers expect.

Lower prices often hide costs such as rework, delayed launches, expedited shipping, or inconsistent quality across reorders. These costs don’t appear on invoices, but they directly impact margin and brand reputation.

How do I know if a hat supplier really understands U.S. brand expectations?

Look at how they frame problems, not just how they quote prices.

Suppliers who understand U.S. brands proactively clarify tolerances, timelines, and trade-offs instead of simply saying “yes.” They focus on predictability and consistency, not just production capability.